+

Connect Expensify and Global VaTax to turn your company’s international expenses into an easy VAT refund.

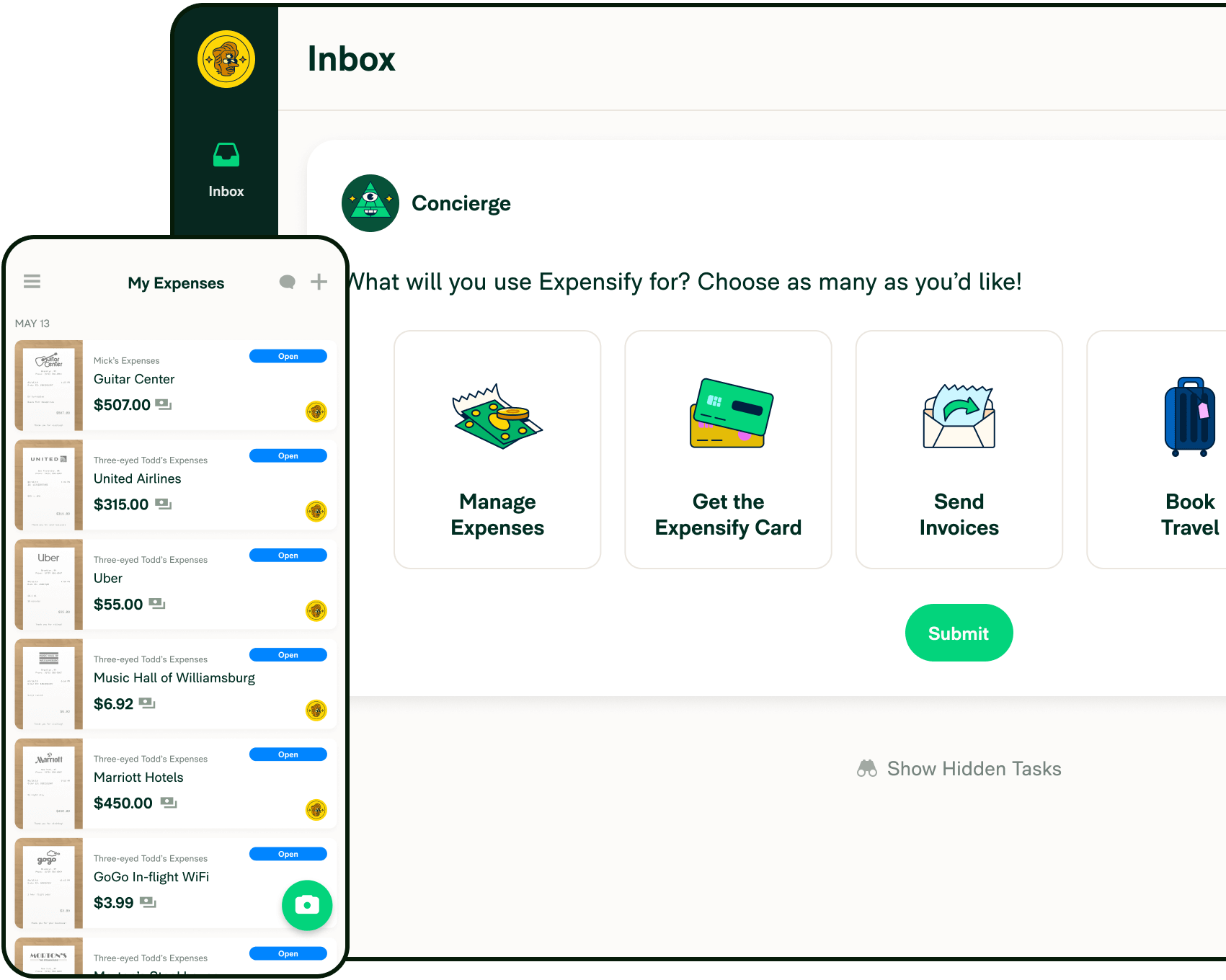

Track expenses around the world

Scan receipts in more than 160 currencies with Expensify, then sync your international expense data to Global VaTax in one click and watch your refund grow.

Maximize your VAT refund

Global VaTax navigates the rules and regulations of more than 30 countries to ensure a maximum VAT refund, wherever business takes you.

Reach out to vat@expensify.com to get started!